tax avoidance vs tax evasion examples

Is tax avoidance legal or illegal. This occurs either when the taxpayer does not pay tax or bypasses assessment.

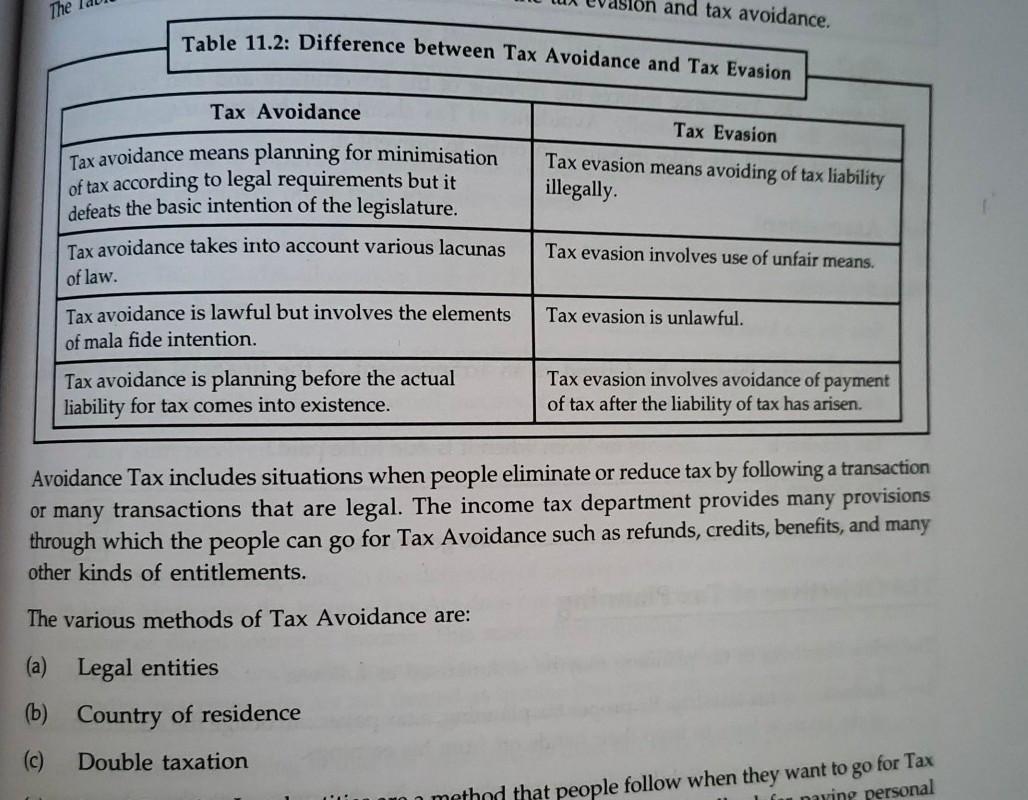

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Federal income tax than necessary because they misunderstand tax laws and fail to keep good records.

. Definition and Examples. Dealing with taxes requires being familiar with some terms that a lot of people often get wrong like tax evasion and tax avoidance. Confusing these two can be the difference.

Some examples of legitimate tax avoidance include putting your money into an Individual Savings Account ISA to avoid paying income tax on the interest earned by your cash savings. When it comes to taxes and the IRS sometimes there is a fine-line between planning to minimize taxes aka legal Tax. The other one is the evasion of.

This is one of the most common tax evasion examples. Some examples of legitimate tax avoidance include putting your money into an Individual Savings Account ISA to avoid paying income tax on the interest earned by your cash savings. According to the IRS tax avoidance is an action you can take to reduce your tax liability and therefore increase your after-tax income.

For example you may have a higher audit risk and your accountant may refuse to work with you on ethical grounds. Classify the tactics below as examples of Tax Avoidance or Tax Evasion by clicking on the. Here are some examples of tax evasion.

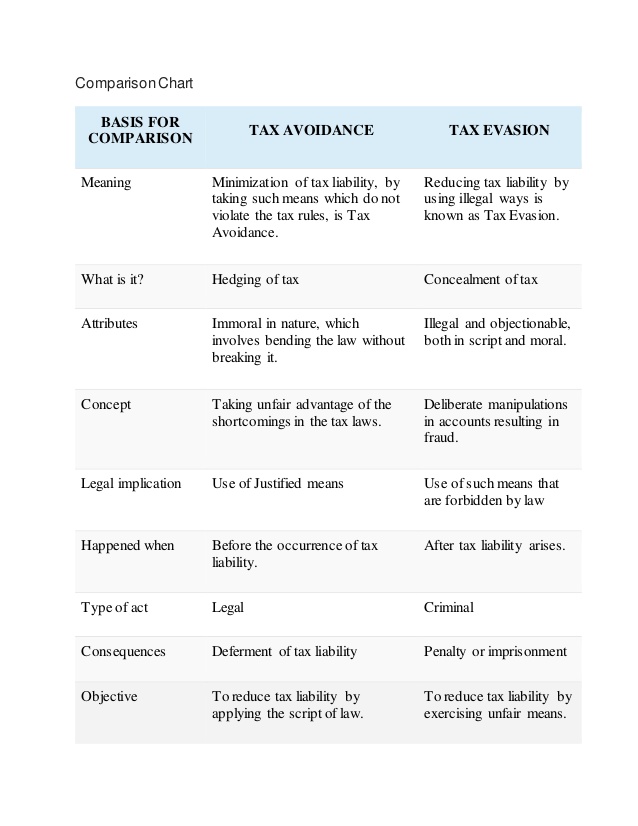

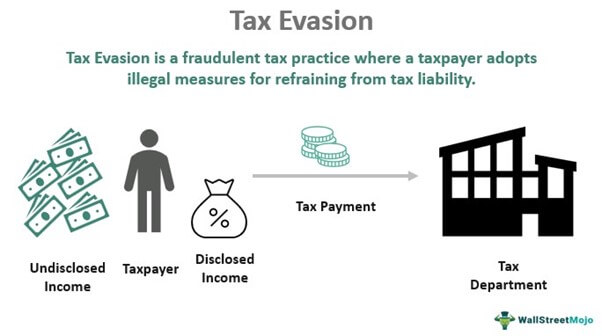

Falsification of accounts manipulation of. Tax Avoidance vs Tax Evasion. If income is not reported by someone authorities do not possess a tax claim on them.

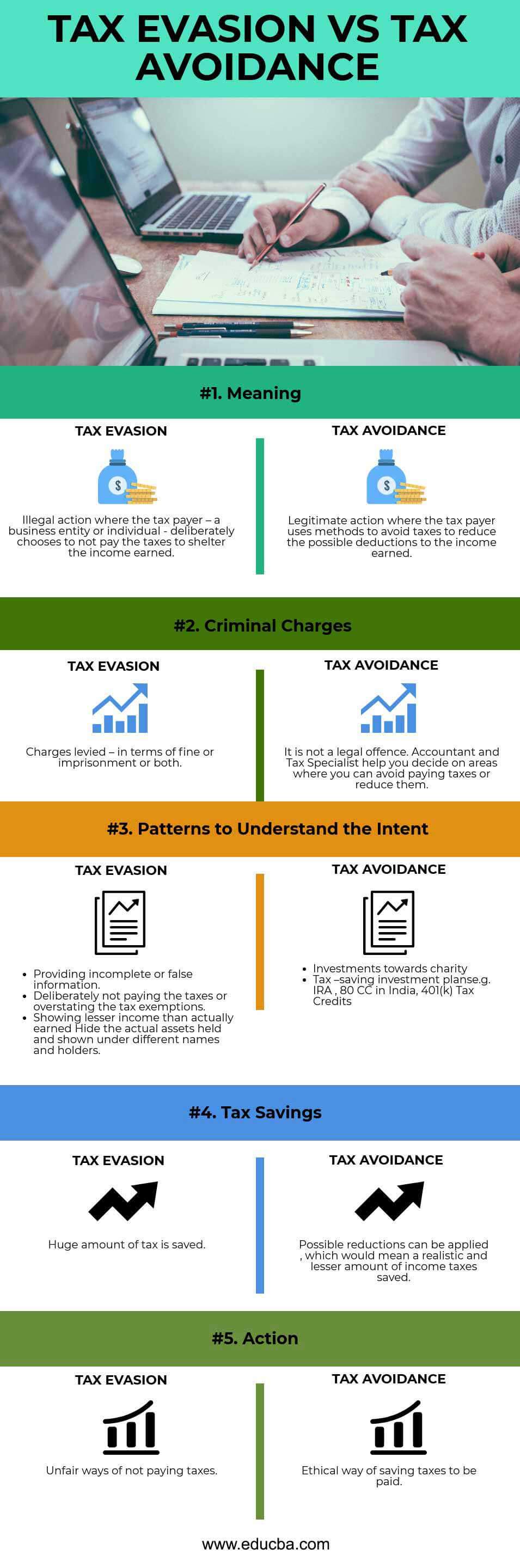

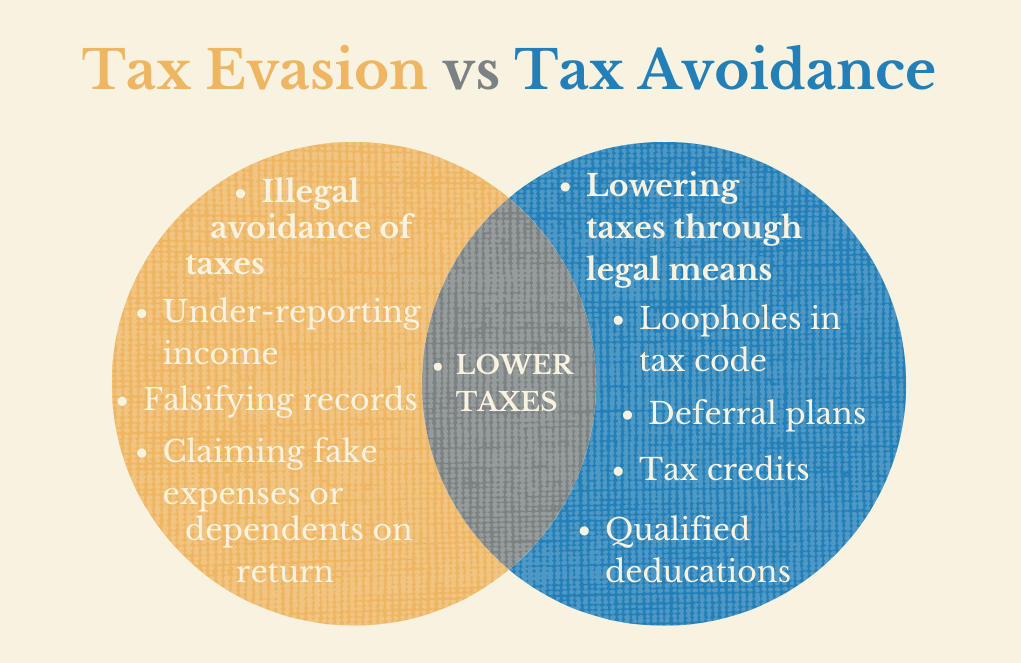

Tax evasion means concealing income or information from tax authorities and its illegal. Tax Evasion vs. When you avoid tax payment via illegal means it is called tax evasion.

Tax avoidance can be termed as an ethical way of reducing taxes and tax evasion can be called an unethical way of reducing the tax burden. Tax evasion occurs when the taxpayer either evades assessment or evades payment. Updated on Friday October 23 2020.

Deliberately under-reporting income the most common cases include. 6 rows Key Differences between Tax Evasion vs Tax Avoidance. Tax evasion is a federal offense.

Call 247 713-775-3050. Tax evasion on the other hand is using illegal means to get out. While both tax avoidance and tax evasion may sound like something that could get you in trouble with the IRS tax avoidance is legal.

The examples below are all classed as tax evasion and are therefore illegal. Are you unsure of the difference in tax avoidance vs. Tax Avoidance vs.

Tax evasion can have other undesirable consequences too. 1 Ignoring overseas income. While tax avoidance is a legal way of reducing the tax to be deducted from the gross income tax evasion Tax.

Activity 1 Circle each example of tax evasion. Let us discuss some of the major differences. Tax Evasion vs Tax Avoidance.

Examples of tax evasion. This often affects people with rental properties overseas. Though both the processes reduce the tax amount they differ in legal terms.

Depending on where a persons tax evasion crime lands in the set categories they may face a. There are prison sentences and hefty fines. Tax evasion is the use of illegal means to avoid paying your taxes.

Examples of tax evasion. Tax avoidance means using the legal means available to you to reduce your tax burden. Get the detail with more examples in this article.

Tax avoidance is perfectly legal and encouraged by the IRS but tax evasion is against the law. Keeping a tip log B.

Tax Avoidance And Tax Evasion Meaning Strategies Consequence And Difference Sheria Na Jamii

Tax Planning Tax Evasion Tax Avoidance And Tax Management Avs Associates

Difference Between Tax Evasion And Tax Avoidance Compare The Difference Between Similar Terms

Tax Evasion Vs Tax Avoidance Definitions Prison Time India Dictionary

Tax Evasion Vs Tax Avoidance Top 4 Differences Infographics

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Tax Evasion Vs Tax Avoidance Top 5 Best Differences With Infographics

Tax Evasion Meaning Types Examples Penalties

Tax Evasion Vs Tax Avoidance Ppt Powerpoint Presentation Gallery Professional Cpb Powerpoint Templates

Investopedia Video Tax Avoidance Vs Tax Evasion Youtube

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Solved The And Tax Avoidance Table 11 2 Difference Between Chegg Com

Tax Evasion Vs Tax Avoidance Top 5 Best Differences With Infographics

Tax Evasion Vs Tax Avoidance What Are The Legal Risks

Tax Avoidance Vs Tax Evasion Infographic Fincor

Facilitating Factors For Tax Avoidance And Tax Evasion Download Scientific Diagram

Tax Evasion Vs Tax Avoidance Top 4 Differences Infographics

Tax Evasion Vs Tax Avoidance Dsj Cpa

Tax Evasion Vs Tax Avoidance Know The Difference Ico Services