are closed end funds safe

While it is down for the year it also puts out a monthly. A closed-end fund is organized as a publicly traded investment company by the Securities and Exchange Commission SEC.

Difference Between Open Ended And Closed Ended Mutual Funds

The term closed-end fund CEF is a bit of a double entendre.

. Among the advantages CEFs - unlike open-end mutual funds - trade at a discount or premium to net asset value. Closed-end funds raise a certain amount of money. CEF structure has been beneficial to take advantage of key market.

Learn About Our Approach. Seven closed-end funds with big dividends. Mutual Funds Retirement Investing Solutions.

Since closed-end funds are usually small niche funds they generally have a much higher management fee than you will find in ETFs. A closed-end fund is a type of investment company whose shares are traded on a stock exchange or in the over-the-counter market. Even closed-end funds CEFs which some investors turn to for relative safety versus individual stocks given CEFs diverse portfolios can sport high leverage of between.

Closed-end funds CEFs can be one solution with yields averaging 673. Their yields range from 632 on average for bond CEFs to 722 for the average stock CEF. Now imagine that a closed-end fund issued the same number of shares at the same price but after it opened to investors the share price of the closed-end fund fell to 8 while the.

The closing price and net asset value NAV of a funds shares will fluctuate with market conditions. 5 Closed-End Funds Worth Buying On Sale. The four main classes.

Choices in Closed-End Funds. Here are 3 tips we can give the starting closed-end fund investor. Therefore short-term downturns do not materially affect them.

Perhaps they should be. AllianzGI Equity Convertible. In exchange for a bit more risk investors clearly get to enjoy a bit more yield.

Closed-end funds may trade at a premium to NAV but often trade at a discount. Closed-end funds use of leverage can be relatively safe if the underlying assets are of high quality and have volatility of around 3 to 4 commensurate with stable assets such as high. Ad Find Risks Of Closed End Funds.

An unintended one Im sure and one we can leverage for safe 6 7 and even 8 yields with upside to boot. Closed-end funds tend to have a longer time period than open-end funds. Learn why over 370K members have invested over 25 billion with Yieldstreet.

The industry offers more than 580 CEFs with assets exceeding 290. Ad Choose From Over 70 Funds With 4 5 Star Ratings From Morningstar. A lot of people google terms like best CEFs to buy in 2021 or top high-yielding closed-end funds and other phrases like that.

ETB is a good choice. So for instance a CEF. Yet closed-end funds CEFs are not nearly as popular as open-end mutual funds.

They Are What They Hold Not A Separate Asset Class Be Aware Of What You Hold. Closed-end funds offer excellent income potential compared to conventional mutual funds ETFs and dividend stocks but come with a number of complexities. One corner of the market that is dirt cheap right is closed-end bond funds CEFs.

A common misunderstanding is that a CEF is a type of traditional mutual fund or an exchange-traded fund ETF. A closed-end fund or CEF is an investment company that is managed by an investment firm. This is a niche market that is mostly ignored by institutional investors and even seems a little.

Count junk bonds in the same category as preferreds and covered calls. Look for Discounts and Premiums. A closed-end fund is not a traditional mutual fund that is closed to new.

Even closed-end funds CEFs which some investors turn to for relative safety versus individual stocks given CEFs diverse portfolios can sport high leverage of between. The closed-end fund can also. Its assets are actively managed by the funds.

Like a mutual fund a closed-end. The Eaton Vance Tax-Managed Buy-Write Income Fund NYSE. Ad Diversify your portfolio by investing in art real estate legal and more asset classes.

SPDR Barclays High Yield Bond ETF JNK Dividend Yield. Along the same lines consider the shares of the Nuveen Credit Strategies Income Fund JQC 654 when looking for the best CEFs of 2022. The most ubiquitous ETFs in the space.

CEFs are an option for experienced investors who enjoy market details. Pros and Cons of Closed-End Funds. Often the fees range from 1-3 of net.

Closed-end fund definition.

Guide To Closed End Funds Money For The Rest Of Us

What Is A Closed End Fund And Should You Invest In One Nerdwallet

Cash App Failed For My Protection Fix Cash App Transfer Failed Issue Cash Out App Fails

The 2 Best Monthly Dividend Stocks Free Bonus Strategy The Money Snowball Dividend Stocks Investing Apps Dividend

Guide To Closed End Funds Money For The Rest Of Us

3 Steps To Grab Safe 7 3 Dividends Forbes Dividend Money Change Irs Taxes

Understanding Closed End Vs Open End Funds What S The Difference

Guide To Closed End Funds Money For The Rest Of Us

Guide To Closed End Funds Money For The Rest Of Us

Difference Between Open Ended And Closed Ended Mutual Funds

What Are Closed End Funds Fidelity

Pin By Curtis Kelly On Stuff For Sale Everything But The Kitchen Sink Investing Hardcover Profit

/GettyImages-1162966566-19102c67f9424a5d9b7eb826332ed48d.jpg)

Understanding Closed End Vs Open End Funds What S The Difference

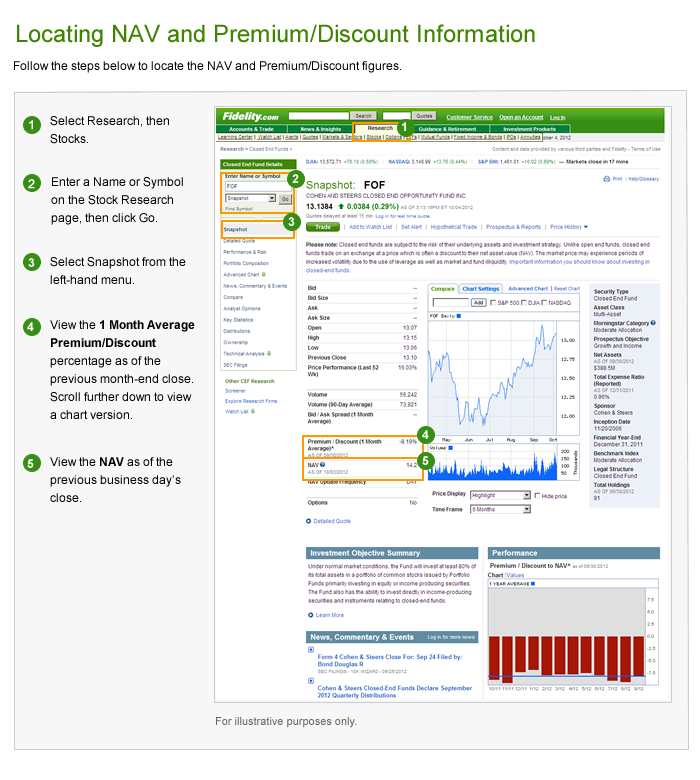

Closed End Fund Cef Discounts And Premiums Fidelity

Balanced Funds Investment Companies Investing Fund Management

Capital Protection Oriented And Dual Advantage Mutual Funds Mutuals Funds Investing Fund

What Are Closed End Funds 3 Risks That Destroy Wealth Finance Advice Bond Funds Fund